I process grief quickly. That doesn’t mean I minimize its potency or its value. When something horrible happens, it is critical to FEEL it. Shed some tears. Scream. Look in the mirror as the veins in your head look like they will explode. Imagine your hair on fire. Be ripshit angry, genuinely sad and broken hearted. That was November 6th. And for several days thereafter.

And now…the anger is the same. But I don’t have time to dwell in sadness. We all have very little time. I am now in a place where I hope most of us will go. Solutions for a financial revolution. A bloodless, peaceful but powerful place of radical economic change.

SOCIAL JUSTICE is ECONOMIC JUSTICE

The beginning. Believe that all Americans are entitled to clean water, adequate food, decent housing, health care, education and help with disabilities. All Americans means all - regardless of race, country of origin, faith or lack thereof, sexual orientation or preference - all. Human rights for all.

The process. That takes money. Lots of it. Can we afford such “fairness”? Absolutely. But it requires puncturing myths. It requires the political will to actually say that no one should go without basic human rights while oligarchs play on their mega-yachts. It means having the courage to say that when children are simply born in the wrong town and are hungry and poorly educated, there is a moral obligation for us to help.

How many times have you heard that the “American Dream” is that we have a capitalist system where anyone “can make it”? Obviously, that is now wishful bullshit that some politicians continue to promote. It may have been true in the past, but now it is a fantasy.

Here is another fantasy. If the rich pay less taxes they will use that money to invest in their businesses - hiring more people with higher wages. And if I eat watermelon seeds, vines will grow out of my ears.

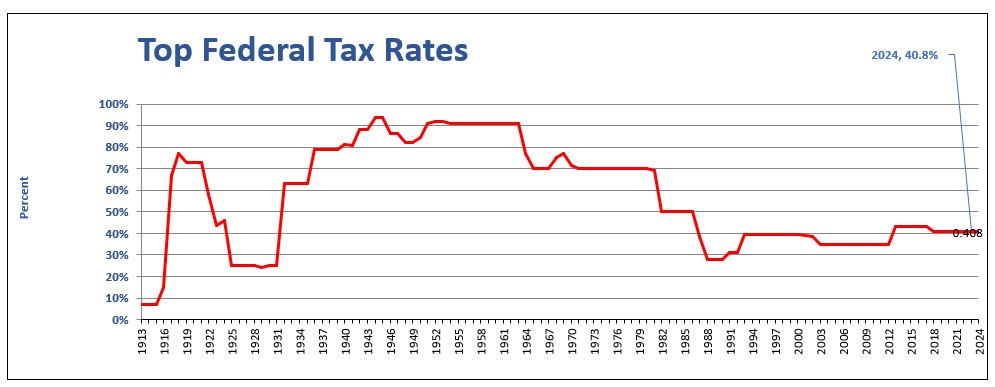

In 1944, the top income tax rate peaked at 94 percent on taxable income over $200,000 ($2.5 million in today’s dollars). To clarify, if this were today’s tax rate the 94% rate would apply to the amount earned OVER the first $2.5 million. This is taxing excessive wealth.

Over the next three decades, the top federal income tax rate remained high, never dipping below 70 percent. And America experienced the fastest growing economy and expansion of wealth for the middle class in our history as a nation. There were plenty of poor people - held back by all the usual suspects. But at least there was hope. There was a solid, expanding middle class. It was the most generally felt prosperity in our history.

And then The Economic Recovery Tax Act of 1981. Ronald Reagan introduced “trickle down economics”. The Republican con game resumed. Trillions flowed up to the ultra wealthy. Yet, middle class wages stagnated.

From Wiki:

”The non-partisan Congressional Research Service (in the Library of Congress) issued a report in 2012 analyzing the effects of tax rates from 1945 to 2010. It concluded that top tax rates have no positive effect on economic growth, saving, investment, or productivity growth. However, the reduced top tax rates increase income inequality:[32]

The reduction in the top tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.[33]”

So let us be clear. For over 40 years, the VERY rich people have paid less in taxes than was socially acceptable during the presidency of Dwight Eisenhower (R) when the marginal tax (taxed after you make $2.5 million) was over 90%. Today that rate is about 40%. Where did that 50% go? It didn’t help the overall economy - as confirmed by the bipartisan experts at the Library of Congress.

That uncollected revenue is a major reason why our national debt has exploded. Of course, the MAGA folks will blame that debt on poor people. And they will now begin to make cuts to the programs that we need to survive. Because THEY didn’t pay their bills - their moral obligations to a civilized society.

And here is also where some of that uncollected 50% went.

Zuckerberg, Musk, Bezos, and other American oligarchs enjoy their toys while millions of Americans work multiple jobs, can’t afford good health insurance, are one financial disaster away from bankruptcy and/or homelessness, and their kids may be attending shitty schools.

Do you still wonder why over 90 million people didn’t vote in our last election, why they feel as if the “system is rigged” against them? Do you have any doubt as to why they think “all politicians are the same”?

Senator Chris Murphy of Connecticut is trying to develop a new Democratic platform that offers help to all Americans. Keep an eye on him and perhaps join in our revolution.

I am revolted by the “Tech Bros” and their wallowing in their new “Gilded Age” riches. Time to reverse the flow of money. Zuck could have 10% of what he has now and still afford big toys.

But don’t listen to me or the politicians. Take it from a Nobel laureate in economics:

”For the Democrats, that message should be clear: abandon neoliberalism and return to your progressive roots in the presidencies of Franklin D Roosevelt and Lyndon B Johnson. The party needs to provide a new vision of a society that offers education and opportunity to all; where markets compete to produce better products that enhance living standards, rather than to devise better ways of exploiting workers, customers, and the environment; where we recognise that we have moved on from the industrial age to an economy oriented around services, knowledge, innovation, and care. A new economy needs new rules and new roles for government.”

Joseph E Stiglitz is a Nobel laureate in economics, university professor at Columbia University and a former chief economist of the World Bank

There is currently a contest for who will lead the Democratic National Committee. I support Ben Wikler of Wisconsin whose message aligns with mine. Our party needs an overhaul - it needs to be the party of CHANGE. A return to the party of FDR. For too long mega donors have called the shots and look where we are now. The image of our party is that of elitism. We need to flip the conversation on it’s head and get upset at the unfairness of the system. We need to channel the very real frustration of most Americans.

I suggest that this hoarding of wealth by the few is immoral in the face of millions who are suffering. What do you think?

https://mediabiasfactcheck.com/the-center-for-economic-and-policy-research/

https://en.wikipedia.org/wiki/Economic_Recovery_Tax_Act_of_1981

https://www.thebulwark.com/p/sen-murphy-im-preparing-for-dystopia?utm_source=substack&utm_campaign=post_embed&utm_medium=web

https://www.theguardian.com/business/2024/nov/28/the-message-to-democrats-is-clear-you-must-dump-neoliberal-economics

“Tax the rich, feed the poor, until there are no rich no more!” — Ten Years After

Those 90 million people who didn’t vote are now forming the revolutionary legions who will overthrow the oligarchy and establish a new world government. The process starts with resistance to corporate abuse and leads to the revolution of consciousness that will fulfill poet Gary Snyder’s long-range vision: “Since it doesn’t seem practical or even desirable to think that direct bloody force will achieve much, it would be best to consider this a continuing ‘revolution of consciousness’ which will be won not by guns but by seizing the key images, myths, archetypes, eschatologies, and ecstasies so that life won’t seem worth living unless one’s on the transforming energy’s side.”

Mankind is enveloped in that process now which will continue to expand until it includes all beings, especially greedy corporate CEOs, investors, and warmongers. If it fails, we will all fail because there won't be a planet left to pursue our dreams on. Meanwhile, assholes like Musk, Zuckerberg, Bezos, Trump et al will remind everyone what being obscenely rich looks like: ludicrous, ugly, mean-spirited, selfish, unenlightened and ultimately — evil.

Good stuff, Bill, well-researched.

I think a bigger opportunity for taxing wealth is closing the massive loopholes that were designed for the wealthy.

One thing I never hear when people talk about the wealthy are complaints about how much money entertainers and athletes make. We bear responsibility for that since we pay the high ticket prices and broadcast fees that make them possible. We've created a lot of wealthy celebrities.

I don't begrudge anybody who is successful in their own right, but not if it comes at the expense of others.