Inflation Nation - part one

What if the Central Bank has it all wrong?

On March 16th, the Federal Reserve Bank announced an interest rate hike of ¼ percent and recently indicated that it may lift rates even more aggressively - as many as six more times this year. And the chair, Jerome Powell added that they “will follow the data and the forecasts and do whatever is necessary to bring inflation under control”.

Finally and way overdue! But, Mr. Powell, this is a terrible time to do it.

Almost zero interest rates have punished savers, pushing them into a volatile stock market. Virtually free loans have enriched the banking oligarchs. Cheap money has kept “zombie” companies afloat. And super low mortgage rates encouraged a surge in home buying by a generation that had been living in their parent’s basements for too long. Ultra-low interest rates have created a stock market bubble and a housing bubble.

Mr. Powell and his team have created a nightmare we will have trouble awakening from. They are following a dangerously outdated playbook that ignores today’s realities. That playbook suggests that the Fed can actually achieve control over inflation with its interest rate yo-yo. It is true that there is a relationship between rates and economic growth – and ultimately inflation. But what we have now is a runaway horse and it can’t be controlled with a length of twine.

I agree with Powell’s premise that inflation is caused by demand outstripping supply. But the current imbalance was not caused by giveaway levels of interest rates. It was caused by explosive demand. It is the result of a broad-based rearrangement of demand due to a worldwide pandemic lock down. Billions that were previously spent on dining out, air travel, cruises and all manner of vacations - hotel rooms - the entire tourism industry saw it’s cash flow rerouted to “stay at home” investments and toys. Consumers wreaked havoc on businesses almost overnight. It began in March of 2020.

Our infrastructure can’t process the reassigned demand. The pandemic and the sporadic emergence from it has revealed systemic flaws in our business systems that are at the root of this current run up of inflation. If the Fed is the fire department they are aiming the hoses at the wrong building.

The first tremors of dramatic inflation were observed in the lumber markets. The price of wood went through the roof. Why? Because Americans who were locked down during the pandemic, couldn’t take vacations and instead used that money on home improvement. New home construction went on a tear to meet pent up demand - unleashed by super cheap mortgages. There wasn’t enough lumber. Key elements like front doors and garage doors were delayed. The Fed called it a temporary, isolated event. But while prices did readjust somewhat over time, the lumber story was just the beginning.

Many of us may remember the warnings prior to Christmas that those special toys should be secured early as supplies were limited. The phrase “supply chain” was beginning to be floated. Then we realized how delicate our “just in time” inventory practices were. We expected our two-day Amazon purchases to be our standard of life. You mean little Markie’s teddy bear may not be available exactly when I want it? But I’ll pay extra! OK, here is one we can deliver in a month for 25% more! That’s inflation and has nothing to do with interest rates.

It has everything to do with Chinese teddy bear factories closing due to the government's Covid policies of zero tolerance. It has everything to do with ports being unable to process the heightened demand for “stay at home” products. And even if the ports could ramp up their speed of container processing, there were not enough truckers to pick up the containers and deliver them to the distribution centers– another story to be addressed later.

We recently purchased a new vehicle. I called four regional dealerships to arrange a test drive. None of them had the popular car we sought. The wait would be “up to 13 weeks” if I pre-ordered - without even sitting in it. And, remember when one could negotiate price? Forget about it. All of the dealers were up front in explaining that they were adding $3000 to the MSRP.

But wait. It gets stranger still. I logged onto an internet based auto “gateway” that offered to purchase vehicles. I filled in the VIN number, answered a few questions about condition. Within 60 seconds, they sent me an FIRM offer to purchase. They offered us $2500 more than we paid for the same car NEW four years ago. All of this enormous inflation in vehicles was caused by the pandemic shutdown of the computer chips factories in China.

It wasn’t interest rates that added tens of thousands of dollars to home construction and renovation. It wasn’t interest rates that made Teddy a high-priced Christmas gift. And it wasn’t interest rates that made cars - new and used - much more expensive.

Many of us of a certain age remember using a savings account. Some may remember bringing a “passbook” to the bank and depositing a little money and having that recorded in our book. We had been taught about “compound interest” and we knew that if we were consistent about deposits, our funds would grow and we could buy or do that big thing. A new car. A college education. A trip. A retirement.

And many will remember when that savings account paid us 3, 4 or 5 percent. Not a lot. But respectable. And with discipline and patience that compounding of interest would pay off. Today, a savings account interest is essentially negligible.

So, where to put those weekly or monthly savings? We have to plan for our futures. For Americans there are two choices if yield is the goal. A “balanced portfolio” of 60% equities and 40% fixed income vehicles is the classic arrangement. Stocks and bonds seem to be the only logical place to park the money. And look at that stock market! Whoo Hoo!

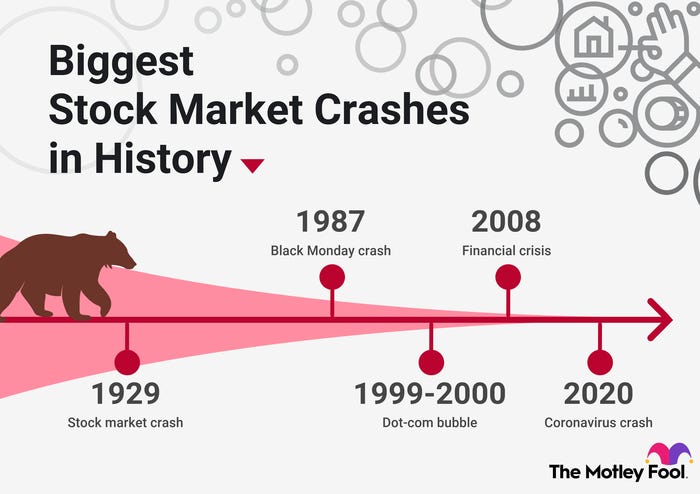

On October 19, 1987, a banking fiasco caused the stock market to crumble. In one day, referred to as “Black Monday”, the Dow Jones Industrial Average dropped by 22.6%. It took two years to recover.

Starting in the year 2000, the “dot com bubble” was pierced with reality causing the DJIA to drop 2 years in a row by about 6 or 7 percent each year. In 2002 it dropped 16.7 percent. It took five years to return to 2000 levels.

In 2008 the housing loan financial crisis sent the DJIA tumbling by 33.8 percent. It would take three years to recover those levels.

On March 16, 2020, the DJIA recorded a 2997-point drop – nearly 13%.

It is absolutely true that over the long haul investing in the stock market can be fruitful. Over the decades, one could expect annual averages of about 10%. But how long is your haul? Will you need the money when your portfolio is peaking or in the pits? A young family that was about to buy that first home in 2002 – could they? The couple that hoped to retire...maybe needed to retire for health reasons...in 2008, could they?

The Federal Reserve has held interest rates too low for too many years now. Savings accounts have paid a pittance. Too many people with low “risk capacity” have shifted their futures into a volatile stock market.

Frugal, disciplined, and conservative (original meaning) savers have been punished by the Federal Reserve Bank.

Aside from the horrors of Putin’s war, the other big nightly news report is that inflation is hitting levels not seen in 40 years. The conventional wisdom is that by slowing the economy through higher interest rates, inflation will be curbed and the value of your dollar will be preserved.

But can a central bank really control a complex multi trillion-dollar economy with little tweaks in interest rates? What if the Fed has it all wrong?

What if raising interest rates this year does little to control inflation because the causes are not an “overheated economy” but a shortage of materials and labor? The average citizen will get punished with a dramatic increase in rates. The rich will be fine. But higher interest charges for credit cards, car loans and adjustable rate mortgages (now trending again) will make life harder for most Americans.

Super low interest rates have been a significant factor in the biggest run-up in housing prices in our lifetimes. For those who were able to secure that fixed rate mortgage at 3%, kudos! I hope you love that new home. Because as rates rise, the next house may be unaffordable in terms of price and borrowing costs. The latest Zillow forecast of home prices in our town predicts a 15% gain - in one year. That’s after a 16% gain over the last year. That works out to a home costing $500,000 in 2021 (if you could find one) costing $667,000 next year. Will raising interest rates help the housing shortage or the ability of a teacher or a cop to buy a home?

What’s the solution to this situation? The Fed finally has the excuse it needs to raise rates. Inflation is becoming a serious issue and the public is freaking out at the gas pump. While I think the timing is silly, the Fed should adjust its plan to raise rates more slowly - incrementally and gently - until they reach that rate that would support savings. It will be painful for borrowers but FDIC insured savings accounts should once again reap at least 3% if not 4 or 5%. Maybe less borrowing and more secure saving would be a good idea? I suggest that the process should take years - not a few months. To move too quickly back to “normal” interest rates will be like using a sledge hammer on a thumb tack.

And then what? Leave rates essentially alone, making only minor adjustments. The Federal Reserve has other functions it needs to address like setting and supervising standards for banks in terms of capital reserves, health checking banks to protect us from financial mayhem as happened in 2008. And perhaps, challenging the fact that there are now just a few major banking institutions.

Why isn’t the central bank exploring inequities in lending practices? Why isn’t the central bank developing more programs of lending to the under served? Now that the Post Office is about to be allowed into the banking business, why not team up and help the little people who don’t have access to banking including small loans? Why not get serious about really helping small businesses that we know are the largest job creators? Why not be the Central Bank for all Americans - not just our oligarchs?

But how to address inflation? Start by rooting out the real causes! Accept the fact that inflation may be part of a financial reset that was sparked by the pandemic and exacerbated by a decades long drive to operate on a “just in time” inventory basis.

And get ready. Should we be shocked when Putin’s war on Ukraine prevents wheat fields from being planted? Ukraine’s farmers are now soldiers. Ukraine and Russia produce a huge percentage of the wheat that Europe and Africa consume. Such a shortage will lead to rising food prices across the world (and famine). Raising interest rates doesn’t help us grow more wheat.

In summary, I think the Fed is misguided. And I think we consider the Fed to be more powerful in terms of efficiently controlling the economy than it really is. Overusing interest rates to control economic activity can be overkill and potentially counterproductive - even devastating - the cause of the next recession. Those of us who lived through the 1970’s remember the pain.

I will have some ideas on how to address our Inflation Nation in part two.

In the meantime, someone much smarter than I has written extensively about this and much more. Robert Reich now publishes a newsletter on substack.

Notes:

https://www.cbsnews.com/news/mortgage-rates-4-percent-adjustable-rate-mortgages/

The current financial state of things in the USA and Canada is completely unsustainable. A revolution is inevitable. Homes in most areas of the US and Canada are unaffordable to the younger generations. I live in a 120-year-old home that has doubled in market value in four years. It is a two-bedroom one-bath on a 5,000 square-foot lot valued at nearly $400k. That's absolutely insane. When entire generations are living at home and avoiding marriage into their 30s because it has become unaffordable something has to break somewhere. That breaking is happening now in slow motion but it could speed up, and it inevitably will.