Be Afraid of AI

Very afraid

Artificial Intelligence is here. It is embedded in everything. Do a search for anything and usually there is an “AI Overview”. Sometimes that is quite helpful. Like you are not sure when is the best time to trim a dogwood tree. Or how to cook a pork roast.

In the Apple TV series “The Morning Show”, the CEO of “UBN” needs a big win - a big new way to grab eyeballs for her fragile network. She turns to AI to make some TV magic. You need to watch this episode. IMO, this series became much more interesting. Better writing. And plot twists that keep you guessing. AI is a “character”.

I have three very big gripes with AI.

Part 1

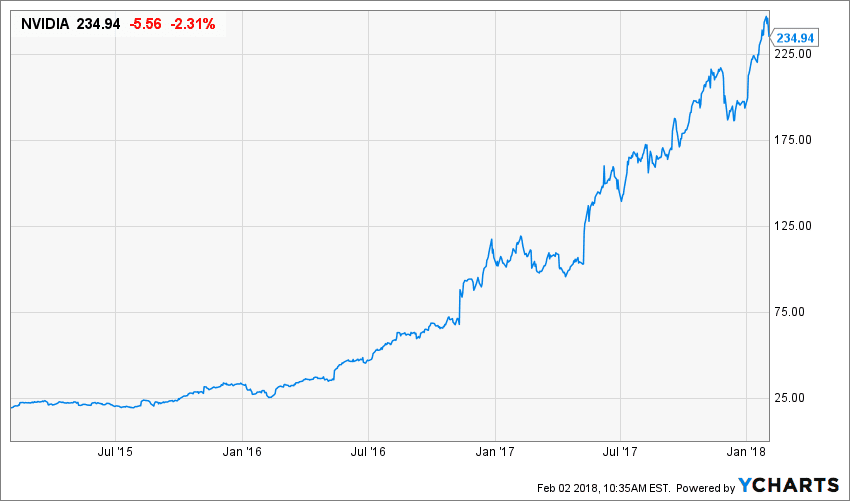

The first is that the major indexes of the stock market are heavily influence by AI companies. They are burning through $100s of billions of investment dollars with no meaningful ROI in the foreseeable future. This is FOMO (fear of missing out) on steroids.

The “Internet” promised huge returns making every investor rich. If a company added “.com” to their publicity, they became players - people ate it up. And then in 2000, the companies began to fall away, tumbling into obscurity carrying portfolios down the drain. AI is bigger. AI is like “tulips” and Ponzi schemes. Too many people chasing vague promise of riches. The people that got in early and left early became very rich.

From Futurism:

”Though the real economy might be circling the toilet, the stock market is doing gangbusters. US stocks grew to record-busting highs this week, fueled almost entirely by investments into AI. Amidst the boom, chipmaker Nvidia became the first company ever valued at $5 trillion in the history of financial markets — a mere 78 days after hitting $4 trillion.

With nothing but good vibes on Wall Street, you’d be hard pressed to find any stock analysts willing to go bet against the giant Nvidia — until now, that is.

Of the 80 analysts covering Nvidia for Bloomberg’s enterprise terminals, 73 of them currently rate Nvidia as a “buy.” Six of them say “hold,” but only one, Seaport Global Securities senior analyst Jay Goldberg, say “sell.”

Many economists have been watching in horror as they warn that AI spending is propping up the US economy with misallocated capital. Wall Street, however, is only seeing green. As Bloomberg notes in its reporting on the analyst, Goldberg is currently swimming against a stream of epic proportions.

“This is not my first bubble,” Goldberg told the publication, referring to the dot-com investment bubble of the late 1990s.

“That feels very strongly like the pattern we’re seeing now,” he continued. “We’re going to build up all this AI stuff for what are largely psychological reasons. At some point the spending will stop, and the whole thing will tumble down and we’ll reset.”

Is OpenAI too big to fail?

Thanks to a complex web of massive deals struck by OpenAI with other tech giants — that in turn is sustaining the global economy — the Sam Altman-led artificial intelligence company might be too big to fail, writes the Wall Street Journal’s Berber Lin:

To achieve his vision of securing seemingly endless computing power for OpenAI, Altman has gone on a dealmaking blitz, playing the egos of Silicon Valley’s giants off one another as they race to cash in on OpenAI’s future growth.

The resulting game of financial one-upmanship has tied the fates of the world’s biggest semiconductor and cloud companies—and vast swaths of the U.S. economy—to OpenAI, essentially making it too big to fail. All of them are now betting on the success of a startup that is nowhere near turning a profit and facing a mounting list of business challenges.

Investors aren’t bothered.

On four separate days over the past two months, the stock prices of Oracle, Nvidia, Advanced Micro Devices, and Broadcom soared after they disclosed OpenAI-related deals—adding a combined $630 billion to their market value in the first day of trading after the announcements. A broader rally in tech stocks followed each time, helping lift the U.S. stock market to record highs.

OpenAI is only expected to generate $13 billion in revenue this year. “Too big to fail” still echoes in my mind. There is no such thing. Please refer to 2008.

What could wrong?

Part 2

My second concern is safety.

Accuracy. If I prune that dogwood tree the wrong way, I will damage a tree. But if I self administer a medication improperly, I could die.

Because I was happy with the AI advice about dogwood trees, I didn’t scroll down and visit the numerous serious and helpful websites dedicated to the subject. Potentially damaging their viability. Less traffic means less revenue. Something that summarizes in a potentially inaccurate manner - is crowding out experts.

How long before medical advice from RFK, Jr ends up in an AI summary?

Part 3

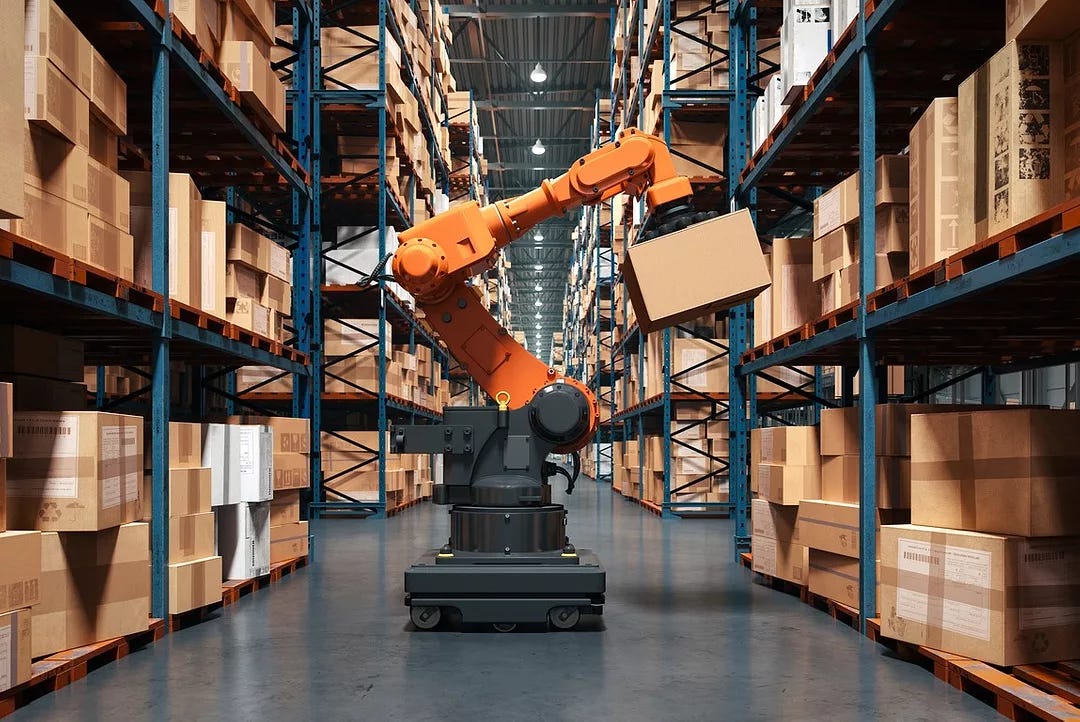

The third concern may be the greatest. Millions of jobs may be at risk. Businesses seek profits by reducing costs. If an AI software program can replace multiple employees - saving the costs of their salaries and benefits, they won’t think twice about it. In fact, if they don’t replace those workers, they will be pilloried by their stock holders.

Millions of workers have been replaced by outsourcing to countries with cheaper labor. Even more employees are being replaced with automation. Amazon just announced that they will replace 600,000 workers with robots. How long before the software engineers and coders are replaced with AI?

AI Overview

Estimates for jobs replaced by AI vary, but several reports suggest it could be in the millions. Goldman Sachs estimates up to 300 million full-time jobs could be affected by automation, while some other reports suggest figures ranging from 400 million to 800 million jobs lost. Many of these are likely to be repetitive administrative, data entry, and customer service roles, though some professional jobs are also at risk. However, AI is also expected to create new jobs and increase productivity, and many roles will likely be transformed rather than fully replaced.

Job replacement estimates

Goldman Sachs predicts that the equivalent of 300 million full-time jobs globally could be affected by automation, with approximately one-quarter of all jobs potentially performed entirely by AI.

Other estimates suggest the impact could be even greater, with some reports projecting that 400 to 800 million people could lose their jobs to AI.

A McKinsey Global Institute report projects that 30% of current U.S. jobs could be automated by 2030.

So what’s the plan for those “replaced” people? There is no plan.

Just like there was no plan for textile workers who were abandoned in the 1970s as manufacturing went to Southern States, then to China, then to India, then to wherever the clothing could be made cheapest. Screw the workers left behind.

Just like the cab drivers who were replaced by underpaid Uber drivers. Just like the small hoteliers and innkeepers who were replaced with AirBnB rentals that lacked licensing for fire safety codes. Screw the people who had worked for years to get a cab license or spent a small fortune adapting their properties to state and local regulations.

Just like the factories all over the middle of the country that were shut down as their production was shipped overseas - decimating thousands of small towns. And we wonder why so many voters are bitter?

We worship creative destruction. I think innovation is terrific. I don’t want to drive a horse and carriage to the grocery store. But when huge numbers of citizens are suddenly unemployed with NO PLAN to retrain them or relocate them or assist them in any way - we have failed as a society.

And we are about to fail American workers in a very big way. Again?

So what’s the plan? Starve them to death? After all, food deprivation is trending.

Of course I can’t escape the irony that I used AI to help write this piece. I am not a Luddite. I love technology. I just think we should be smart and think before we leap. Make a plan. Because people are more important than computer processors, no?

https://www.theverge.com/news/803257/amazon-robotics-automation-replace-600000-human-jobs

What will the next generation of robot-replaced workers do for work?

Scott Galloway recently said that, given the overvaluation of these companies, their clients would have to decimate their (professional) workforces to produce a return that would justify the AI company valuations. One pushback I read is that well this happens all the time as old technologies (buggy whips) yield to the new. I see two caveats: this job destruction will happen very quickly, and will affect a highly visible and vocal population. The powerful can’t be bothered to care about cab drivers and minimum wage workers. But they rely on the disposable income of upper-middle-income folks. They spend freely, run up a lot of debt, and act politically as if they are important. When this bubble bursts, it’s going to rain acid and no one will be unaffected.